Market Noise: Stop Overanalyzing Those Minuscule Moves!

Market Noise: Stop Overanalyzing Those Minuscule Moves!

Market noise is (and will always be) present in financial markets as long as these markets continue to operate effectively and with ample liquidity. However, the vast majority of price fluctuations you observe on a daily basis is due to noise. Reacting too much to noise will likely cause you to see the trees but miss the forest when it comes to trading and investing. As a result, your PnL will at best be a random fluctuation reflective of the markets and at worst, deep in the red due to your panic in reaction to merely random movements.

Market noise is something that every trader lives and breathes, whether they like it or not, but it’s difficult to define precisely. So let’s first define it by what it is NOT by imagining a market that has NO noise. Prices will remain as flat as the ground when there is no interesting news for a particular security and move in predictable and smooth curves like the following:

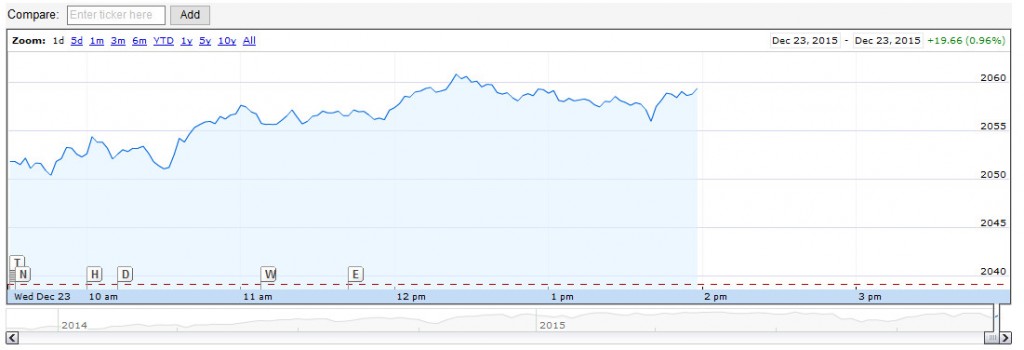

As opposed to this:

Smooth curves in asset prices are not sustainable in relatively liquid financial markets due to simple human greed. Traders who see a stock that’s slowly but consistently marching upwards will buy that stock, causing its price to surge. Bears will then see the sudden price surge and interpret it as a market inefficiency and sell or short the stock, bringing the price back down. When enough traders all do this on a relatively short time scale, random price fluctuations known as market noise ensues.

So what should I do about market noise?

Despite its ubiquity in the markets, whether a particular move in a security is legitimate or simply market noise is often more difficult to determine in real time than in hindsight. Here are some ways you can mitigate the perils of market noise:

- First, make sure you’re looking at a time interval that’s a reasonable fraction of your intended time frame for trading that security. If you intend to hold the security for a year, it makes no sense to follow it on a 5 minute chart everyday as the vast majority of its moves on that time frame, for all practical purposes, will be merely noise. In other words, ask yourself if that move is significant with respect to the bigger picture!

- Second, check for social media activity on the security to gauge its sentiment (as opposed to major news outlets which are often slow to publish the latest info.)

- Third, resist the urge for perfection. It’s OK to miss a move because you suspected it to be noise; there’s gonna be countless more opportunities to make in the future. Exception: if your loss threshold (that you’ve set in your investment plan) is hit, always get out even if you suspect it to be noise!

- Fourth, and most importantly, only trade when you are in a calm and neutral mood. And always stick to your trading or investment plan as long as you’ve not hit your threshold for losses.

Remember, the vast majority of day to day moves in any security is just noise. Refraining from trading on the noise, while easier said than done, will not only keep you from making unnecessary trades but will also keep your mind clear so you can effectively deal with it when the major trading opportunities finally arrive.